How Car Insurance Claims Process Works Insurance is a common term that we encounter regularly. Whether it’s life insurance, health insurance, or travel insurance, nearly every aspect of our lives is now protected, providing us with a safety cushion in case of any unforeseen events. The current pandemic has underscored the significance of being ready for the unexpected and the role of insurance in protecting us and our belongings, such as our vehicles. Therefore, it is essential to be familiar with the specifics of our car insurance policy. Here is a list of key points to consider when filing insurance claims for your car.

Outlines Of Guide

ToggleHow Car Insurance Claims Process Works

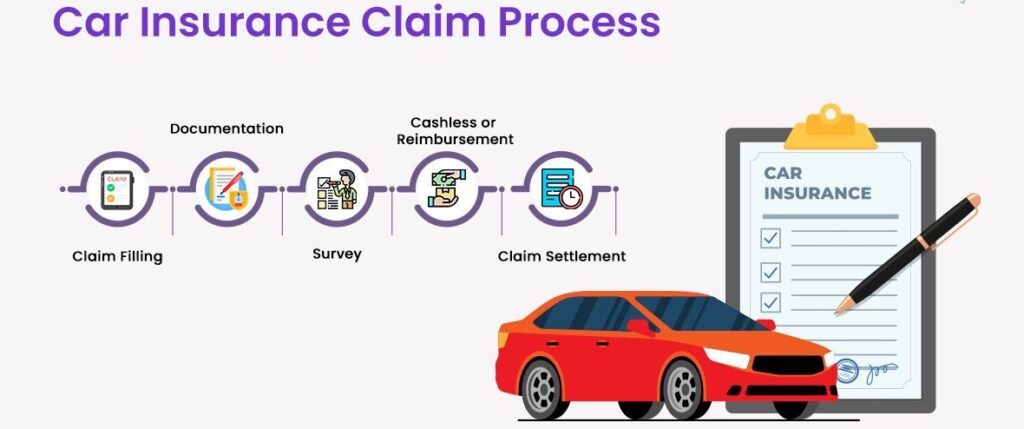

The car insurance claims process has become more streamlined and efficient. When you need to file a claim, you can typically do so online or through a mobile app, making it easier and more convenient than ever before. Once you’ve submitted your claim, an adjuster will be assigned to assess the damage and determine the amount of coverage you are eligible for. In some cases, a virtual evaluation may be conducted using photos or videos of the damage. Once the evaluation is complete, the insurance company will provide an estimate for repairs or replacement. If approved, you can then proceed with getting your vehicle repaired or replaced, and the insurance company will handle the payment directly with the repair shop or dealership. With advancements in technology and improved processes, the car insurance claims process in 2025 is designed to minimize stress and get you back on the road as quickly as possible.

What is the Importance of Car Insurance?

It is essential to have a comprehensive car insurance cover in India for financial security and legal compliance. The Motor Vehicles Act of 1988 mandates all vehicles to have third-party insurance. Opting for comprehensive coverage is advisable as it provides protection against a wide range of risks, including man-made and natural calamities. Car insurance also facilitates recovery from unforeseen events in various ways.

- Offering financial benefits to survivors in case the accident causes fatal injuries.

- Offering cover against potential lawsuits, including the legal fees, in case of legal proceedings following an accident.

- Offering coverage on bills pertaining to vehicle repairs following damage caused by accidents.

- Offering coverage in case of any other man-made or natural calamities causing damage to the car.

- Car insurance also permits customers to avail premium discounts for theft.

- Owning multiple policies with the same insurance provider also offers significant premium discounts.

- Comprehensive car insurance policies also enable you to extend coverage to other people driving your car with your permission, thus protecting you even when you are not behind the wheel.

- In case you do not raise any claims at the end of your policy or tenure, you will be eligible for a no claim bonus on renewals, as long as you meet certain predetermined terms and conditions.

What Does the Car Insurance Claims Process Entail?

The primary reason for buying an insurance policy is to make sure that the insurance funds can assist with covering expenses during times of need. In the context of insurance, the crucial moment is determined by the simplicity of the claims and settlement procedure. When you opt for purchasing a vehicle and obtaining comprehensive insurance coverage, you might have worries about navigating the claims process following an accident or unexpected event. This comprehensive guide outlines all the factors to consider when dealing with the car insurance claims process.

Initially, an insurance claim is a formal request made by the policyholder to the insurance company, seeking reimbursement for the incurred loss or damage. After the claim is reviewed and validated, the insurance company provides compensation as per the coverage outlined in the insurance policy.

Types of Claims

There are two ways to make a claim – through the cashless method or the reimbursement method. If you have your car repaired at a partner garage after an accident, your insurance claim will be settled in a cashless manner. Insurance companies have partnerships with garage chains, so it’s advisable to check which garages are affiliated with your insurance company for efficient claim resolutions. When the insurance provider has a direct payment arrangement with the partner garage, it offers greater convenience. However, if you choose a non-partnered garage, you will need to make the payments and then submit the bills for reimbursement.

After completing this process, you are eligible to receive reimbursement for the repair costs from your insurance company. You can also file for reimbursement in cases where third party claims are made against you. If you make direct payments to the third party, you may be reimbursed by your insurance company, subject to the terms and conditions outlined in the policy. Here are a set of inquiries that arise when filing a car insurance claim.

Documents required when filing a car insurance claim

Based on the nature of your claim, you will be required to submit all or some of the following documents:

- Copy of your car insurance policy

- Copy of your driver’s license

- Copy of your car’s registration certificate

- First Information Report (FIR)

- Estimate of the damages and repairs

- Medical report (only in case of physical injuries)

- All records of other expenses which are being claimed

- Photographs if available

Steps to file a claim for damages to personal vehicles

You will have to follow these steps while filing a claim for damages to your own car:

- First, you must make sure that you inform your company in advance before sending your car to the garage for repairs. Once you do this, the company will send a surveyor to examine and verify the damages, making it easier to get the claims reimbursed. You and your insurance provider will both receive copies of the examiner’s report, offering evidence of the damage caused and an evaluation of the extent of damages.

- Second, you must fill and submit the designated claim form to your insurance provider. This can be done both online and offline. However, you must ensure that you do not leave out any important details.

- Third, along with the form, you must submit the requested documents which usually include a copy of your driving license and car registration certificate. In the case of theft or highway accidents, you must also submit a copy of the FIR filed with the police.

- Once the car is repaired and you receive the bill, you should submit a copy of the bill to supplement your claim.

- Following the examination and verification of all the documents, the insurance company will process the claim and reimburse you for the damages incurred.

Steps to file a claim for third-party damages

If you have been involved in an accident that resulted in injury to a third party or damage to third-party property, you can use the following steps to make a claim:

- Inform your insurance company as soon as you receive the claim notice. Along with this, also submit the registration certificate of your car, your driving license, and the FIR filed with the police.

- The insurer will provide you with the services of a lawyer once the documents are verified.

- Once the case goes to court, if you are found liable to pay damages, your insurer will make the payment on your behalf, in line with the sum insured.

Steps to file a claim for theft

If your car has been stolen, you can take the following steps to file a claim with your insurance provider:

- First, as soon as possible, lodge a police complaint and file an FIR. Once this is done, send a copy of the FIR to your insurance company. Along with this, also send a copy of the final police report along with the registration certificate.

- Once the documents are verified, and all the formalities are completed, the insurance company will reimburse you for the sum insured.

Best Car Insurance Companies For 2025

What Is Uninsured Motorist Coverage?

7 Best Classic Car Insurance Companies

Best Health Insurance Companies

What to Do After a Car Accident?

Accidents are unexpected and they tend to confuse us. If you are in an accident, these things can help you raise a claim more effectively:

- Immediately assess yourself and your car for damages. Based on your condition, decide whether you require medical assistance or not.

- Try to note the details of the other party, in case another vehicle is involved in the accident. This will help identify the other party sooner.

- If possible, take down the contact details of witnesses in the vicinity as they can corroborate your account.

- Inform your insurance company and request for a surveyor.

- If you have access to a partner garage, you can now choose the cashless claims option to ease the process.

- Most insurers require claims to be raised within 24 hours of the accident, so ensure that you do not delay this.

- Keep all the required documents handy to ensure that your claim gets processed as soon as possible.

Summary

Owning a car brings joy, but also comes with responsibilities. Being fully prepared for accidents is crucial, and comprehensive car insurance is essential for this. It’s also important to have a good understanding of the claims process since people often become anxious and overlook important details after an accident. It’s advisable to streamline the process for your insurance company to facilitate successful claim reimbursement. Remember, it’s wiser to prioritize safety over regrets.

How Car Insurance Claims Process Works 2025 Faqs

What is the process of car insurance claim?

The insurer will verify the documents and assess the accident and if found satisfactory, you will get a lawyer appointed by them. If the court directs you to pay the damages to the third party thereafter, the insurance company will directly pay the dues to the third party.

Why are car insurance claims rejected?

If you’re not able to submit any of the documents asked by your insurance provider, your car insurance claim might get rejected. Hence, it’s crucial to collate all the required documents before filing a claim.

Can we claim car insurance without accident?

Non-accident damages can include fire damage, vandalism, natural disasters, etc. Comprehensive car insurance will cover if the car is damaged due to one of these incidents. Shriram Car Insurance offers policies that can provide all-round protection from any possible external and internal damages.