1 JPY To USD Convert Japanese Yen To United States Dollar In today’s world of constantly fluctuating exchange rates, keeping track of currency rates against various global currencies is crucial. To provide better insight into the current scenario, a currency converter tool has been created for easy use. The tool provides up-to-date information on market trends as the rates are updated frequently.With the extreme volatility in global currencies, it is essential to keep track of currency rates to make informed decisions regarding travel or international business transactions. The currency converter tool can also be beneficial for investors looking to invest in foreign markets and need to know the current exchange rate before making any investment decisions.

Moreover, understanding how exchange rates work can help you avoid unnecessary expenses when traveling abroad or conducting business with a company from another country. Exchange rates determine how much your home country’s currency is worth in relation to another country’s currency. By using a currency converter tool, you can calculate how much money you need to pay or receive in different currencies accurately.It is important to note that exchange rates are influenced by various factors such as political instability, economic conditions, and interest rates. Therefore, staying informed about these factors and tracking currency rates regularly can help you make better decisions and avoid financial losses.

Outlines Of Guide

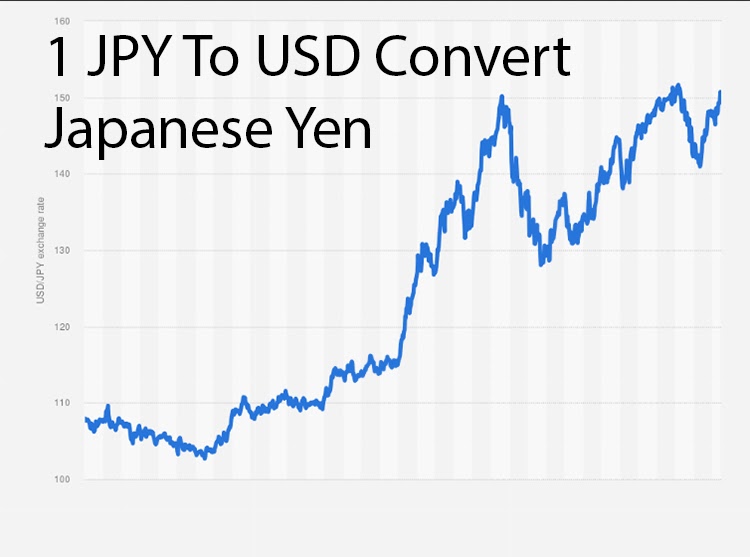

ToggleJPY to USD Chart

If you’re headed to the US soon, it is advisable to exchange some of your local currency for US dollars. The official currency of the United States is the US dollar, indicated by the international symbol USD. It is widely accepted throughout the country and can be used for transactions ranging from buying groceries to paying for transportation services. It’s important to note that exchanging money at airports or tourist areas may result in higher fees, so it’s best to compare rates at different exchange centers before making a decision.

The U.S. dollar is colloquially known as a “buck,” but when it comes to converting Japanese yen to U.S. dollars, there are a few things you need to keep in mind. Firstly, it’s important to secure the best exchange rates possible to get the most value for your money. One way to do this is by checking rates at different banks or currency exchange services. Secondly, be wary of high conversion fees that can eat into your savings. To avoid these fees, consider using a credit card that doesn’t charge foreign transaction fees or finding an ATM that offers free withdrawals. By being mindful of these factors, you can make the most out of your currency conversion and stretch your travel budget even further.

How to Convert Japanese Yen to U.S. Dollars

The conversion of Japanese yen to USD is relatively straightforward, and you have a couple of options for calculating it. You can use an online currency converter or a calculator to get an accurate exchange rate. Alternatively, you can do the conversion by hand using the current exchange rate for the two currencies. It’s always a good idea to double-check your calculations or use a reliable currency converter to ensure accuracy when making financial transactions involving foreign currencies.

1. Use a Currency Calculator

If you’re looking for a quick and accurate way to convert currency, using a currency conversion calculator is your best bet. These calculators take into account the daily fluctuations in exchange rates and provide an estimate of how much one currency is worth in another. This can be especially helpful when traveling abroad or conducting international business transactions. By using a calculator, you can ensure that your math is correct and avoid any costly mistakes due to miscalculations. Additionally, many currency conversion calculators are available online for free, making it easy to access from anywhere with an internet connection.

When exchanging currency, it is important to remember that there may be additional fees that a conversion calculator cannot account for. Credit card companies and ATM networks often charge a 1% conversion fee on all foreign transactions, and some merchants may add supplementary fees if you request them to convert the item’s price to your home currency during checkout. These fees can add up quickly, so it’s essential to factor them into your budget when planning a trip abroad. Additionally, it is advisable to research the best ways to exchange currency before traveling to avoid unnecessary expenses.

2. Calculate it Manually

If you prefer to calculate currency exchange rates manually, you can use a straightforward mathematical formula. However, this requires knowledge of the current exchange rate. As of now, 1 Japanese Yen (JPY) is equivalent to $0.007 US dollars (USD). To calculate the exchange rate for a specific amount, multiply the amount in JPY by the current exchange rate in USD. For instance, if you want to convert ¥10,000 JPY to USD, simply multiply 10,000 by 0.007 to get $70 USD. Keep in mind that exchange rates are subject to fluctuation and may change frequently throughout the day.

To calculate the amount of USD you have for your trip, you need to multiply the JPY amount you have by the current exchange rate. This will give you a figure that reflects how much money you can spend while traveling. It’s important to keep an eye on the exchange rate as it can fluctuate frequently, which can impact your budget. Before embarking on your trip, make sure to check the latest exchange rates and plan accordingly to ensure a smooth and stress-free travel experience.

Manual Currency Conversion Example

When planning a trip to the United States and you have ¥100,000 JPY, you can easily calculate how much money you have in USD by utilizing the current exchange rate. The formula for currency conversion is quite simple: multiply the amount of JPY that you have by the current exchange rate. In case the exchange rate is 0.007, then ¥100,000 JPY will be equivalent to $700 USD. It is crucial to keep a close watch on exchange rates since they can fluctuate frequently and significantly impact your travel budget. You can also use various online currency conversion tools or consult with your bank before traveling to ensure that you have an accurate estimate of how much money you will need for your trip.

How to Buy USD

It’s advisable to plan in advance when purchasing USD to minimize fees. Here are three methods to acquire the needed currency while reducing charges.

- Exchange at a bank or credit union before your trip: Visiting your bank before your journey is frequently the most economical method of currency exchange. Due to your established connection with them, your bank is expected to provide the most favorable exchange rates and impose minimal fees. For instance, Sony Bank usually applies a 0.15% JPY rate for each transaction, although it may occasionally have periods with no promotional fees.

- Use your bank’s ATM abroad for withdrawals where possible: In the same way, if you require to convert a larger amount of currency during your travels, attempt to locate an ATM that is part of your bank’s network. For instance, J.P. Morgan operates branches in both Japan and the United States. Many banking applications offer an “ATM locator” tool to assist you in finding the nearest ATM, and utilizing an ATM associated with your bank can prevent unnecessary fees.

- Order currency online: In case your bank does not provide online currency delivery services, you have the option to utilize a third-party service for having the currency delivered to your location. It’s important to note that some of these providers may have higher costs. For example, Nihonex claims to have no exchange fee, but there is a delivery charge of up to ¥700. However, this fee is exempted for transactions exceeding ¥100,000 JPY.

1 USD To CNY Convert United States Dollar To Chinese Yuan

Federal Funds Rate History 1990 to 2025

401(k) Contribution Limits For 2025

What to Avoid When Exchanging Currency

- Exchanging currency at the airport: Although exchanging currency at the airport is incredibly convenient, it often comes with a high price tag. Airport kiosks are notorious for offering some of the worst exchange rates while charging exorbitant fees. It’s always best to compare rates and fees before exchanging currency to ensure that you’re getting the best deal possible. Consider using a bank or reputable foreign exchange provider instead of airport kiosks to save money on your currency exchange.

- Exchanging currency at your hotel: While some hotels, especially business chains, may provide currency exchange services, they usually charge additional fees for their convenience. If you’re planning to use this service, be sure to compare the fees with other options such as local banks or currency exchange kiosks. It is important to note that these alternative services may offer better exchange rates and lower fees. Additionally, it is always a good idea to have some local currency on hand for smaller purchases and tips.